Gasoline prices spark political reactions across continents

Crude prices continued to rally, at 85.7 $/b at the prompt for ICE Brent Dec-21 contract, as Asian nations multiplied calls to oil producers to…

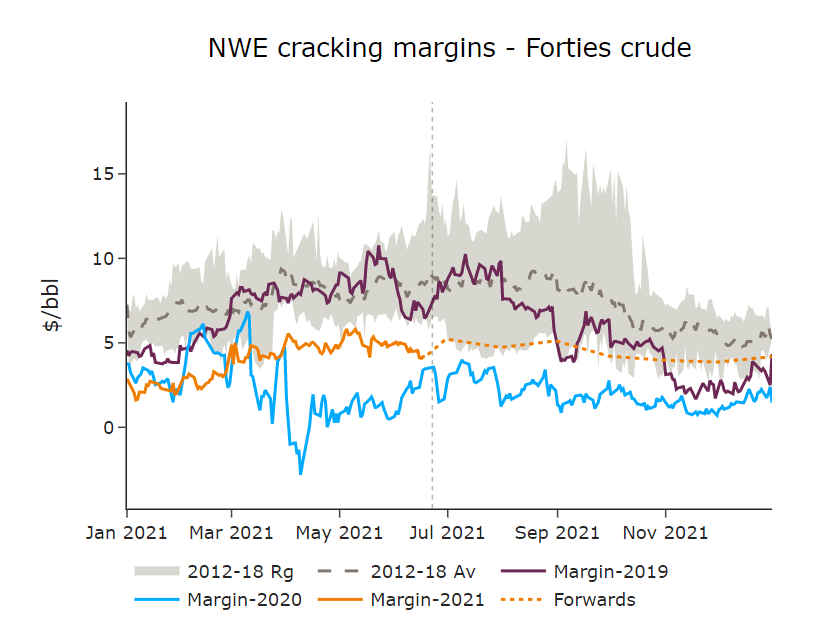

While ICE Brent prompt price for August expiry jumped to 75 $/b on early Tuesday, the spread between US crude (light sweet WTI) and the ICE Brent benchmark narrowed spectacularly from –2.4 $/b to –2 $/b. Gasoil cracks and other refined product prices did not rally as quickly as crude prices, leaving the ICE gasoil crack to a paltry level of 5.8 $/b at the prompt, a level not experienced since mid-April.

Get more analysis and data with our Premium subscription

Ask for a free trial here