Inventories build but the rally in cracks continues

Brent prompt future contract approached 60 $/b on Tuesday, as Saudi OSPs unveiled the bullish Saudi outlook on prices while holding premiums to Asian customers…

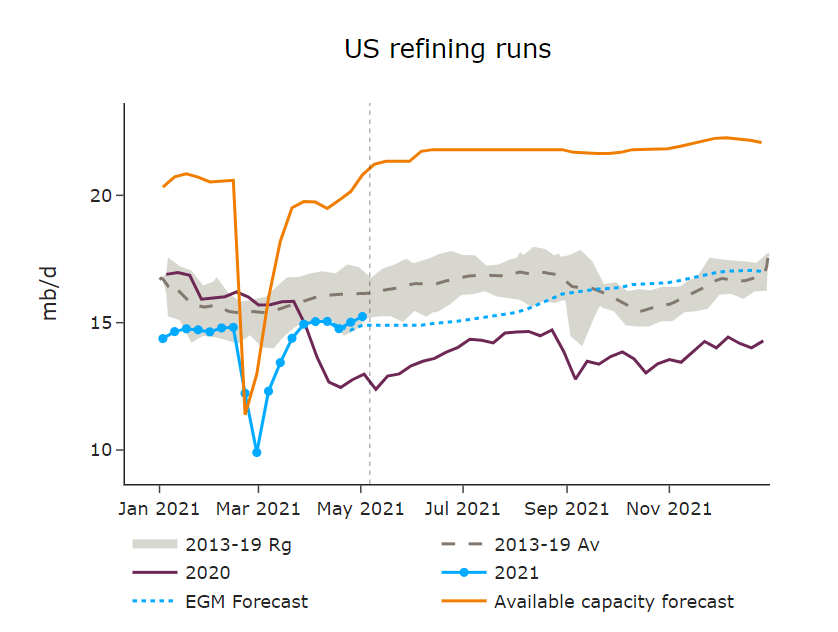

ICE Brent prompt contract eased to 69 $/b, as EIA released a slightly less bullish set of numbers compared to the API survey for the US petroleum market. US crude stocks were still depleted by 8 mb, as refineries ramped up by 0.2 mb/d w/w. Saudi OSPs to Asia for June shipments were set lower compared to last month, with a 30 cents cut on the heaviest crude and 10 cents on the Arab Light flagship crude.

Get more analysis and data with our Premium subscription

Ask for a free trial here