Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

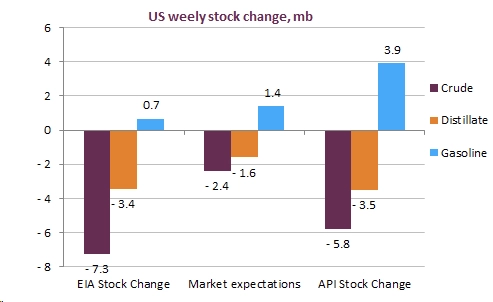

Brent prompt future contract came back to 63.2 $/b, led by a patchy restart of the Texan oil infrastructure. Damages to refineries appear to be greater than previously anticipated, casting doubt on the future US refining runs. Furthermore, futures prices came under renewed pressure from the potential revival of the Iranian nuclear deal, as the US showed a willingness to rejoin the deal as is. The EIA release of the week prior to the Texan energy crisis showed a bullish picture for US petroleum markets, with a 7 mb crude inventory draw and a recovery of the US gasoline demand.

Get more analysis and data with our Premium subscription

Ask for a free trial here

We will get back in touch with you soon.

Don’t forget to follow us on twitter!