Spread vs outright

ICE Brent and WTI’s entire forward curve sold off yesterday by about 3$/b, as the whole commodity complex suffered from a continued rise of the dollar.…

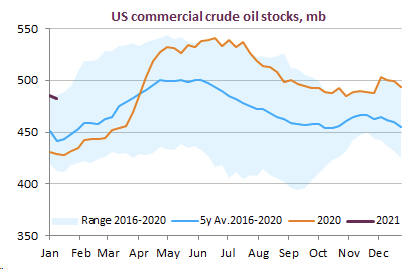

Brent prompt future prices retreated by 1$ at 56 $/b as most European countries doubled-down on restriction measures due to the expansion of the new strain of coronavirus. However, improved market conditions in the US, with an inventory draw in US commercial stocks and higher refining runs, are helping prices to potentially solidify at current levels. Chinese customs detailed preliminary trade data, showing December’s crude oil imports 15% below November’s level.

Get more analysis and data with our Premium subscription

Ask for a free trial here