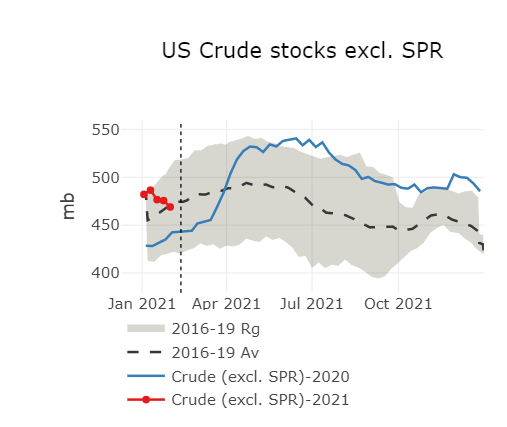

US markets may rebalance faster than expected

Brent futures prices recovered as of early Wednesday, at 68.8 $/b as the API survey showed a surprise draw in crude oil stocks, demonstrating a…

Brent prompt future price consolidated at 61 $/b, amid an increasingly bullish US crude market, pushing US grades higher compared to North Sea values. However, US gasoline stocks builds were larger than expected, with US mobility likely impacted by cold weather. Russian crude oil output could be lower in February, as the first 10 days of production are at 10.11 mb/d. At the same time, the Asian physical crude market is firming up, with OSPs being maintained at January’s differentials and Far East crude grades rallying.

Get more analysis and data with our Premium subscription

Ask for a free trial here

We will get back in touch with you soon.

Don’t forget to follow us on twitter!