Lower credit rates in China

The yo-yoing continues on the markets: after a new decline in the equity markets yesterday and a sharp drop in long term rates (10 years…

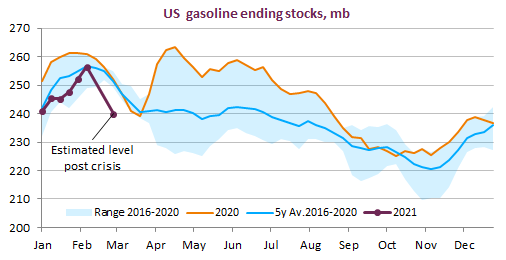

Brent prompt future contract climbed to 63.6 $/b on early Wednesday, as the Texan energy crisis continues to wreak havoc on the state’ oil infrastructure. With the whole Midwest region is also affected by cold temperatures, losses in refining capacity are estimated at 4 mb/d in the US. Japanese crude stocks fell amid a rise in domestic refining runs.

Get more analysis and data with our Premium subscription

Ask for a free trial here