Margin squeeze

Brent prompt futures continued to rally to 54.7 $/b on early Thursday as Saudi Arabia guaranteed that their voluntary supply cut would last two months…

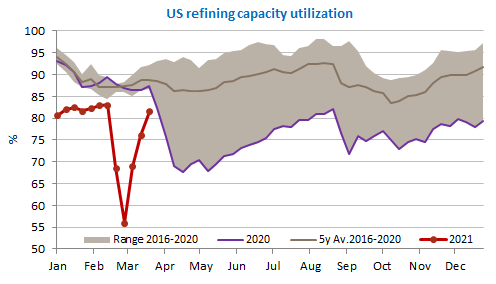

Brent 1st-nearby prices posted a $4/b gain yesterday. WTI prices did about the same. They respectively ended the day above $64.5/b and $61.2/b, therefore erasing their losses of the previous day. The main reason was the Suez canal still blocked by a giant ship that has deviated from its course for unclear reasons. Then, the release of the weekly EIA report in the US showed a new rise in inventories but normalization in demand from refineries as well, therefore pushing prices higher.

Get more analysis and data with our Premium subscription

Ask for a free trial here