The market in search of certainty

Bond yields have rebounded, equities as well and the USD has lost some ground, the EUR/USD exchange rate returning above 1.19… before falling back below…

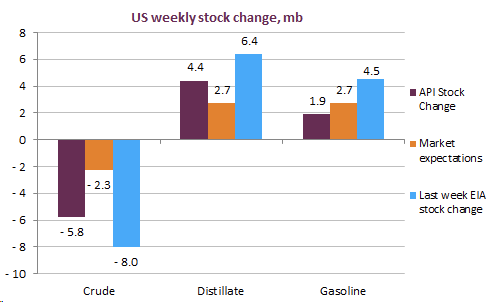

Brent prompt futures continued to hike, at 57$/b on early Wednesday as the API data showed a bigger than expected crude inventory draw in the US. Both gasoline and distillate stocks grew amid falling US demand and growing refining supply. In its latest Short-Term Energy Outlook, the EIA still predicts brent price to average 53$/b in 2021 and 2022 amid ample supplies and worsening global liquid demand.

Get more analysis and data with our Premium subscription

Ask for a free trial here