Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

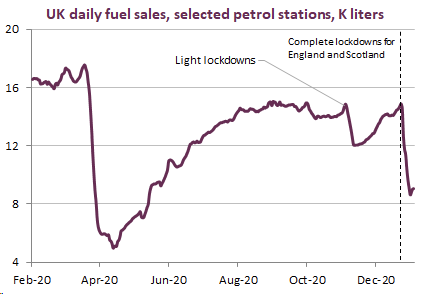

Brent prompt contract reached 56 $/b on Friday close for Brent prompt contract thanks to the aggressive Saudi production cut announced last Tuesday. Prices retreated to 55.2 $/b on early Monday as mounting coronavirus cases in China led to lockdowns in regions near Beijing, casting doubt on the future Chinese demand growth if reported cases were to skyrocket. Furthermore, European countries are moving toward more stringent policies for fighting the pandemic, as the new strain of coronavirus challenges European recovery. Middle-eastern producers moved toward a more aggressive pricing policy, taking advantage of Saudi production cuts. Kazakhstan’s production compliance was marginally below target, at 96%, in December.

Get more analysis and data with our Premium subscription

Ask for a free trial here

We will get back in touch with you soon.

Don’t forget to follow us on twitter!