Bears keep control of crude prices

Brent first nearby prices are hovering above the $100/b mark this morning after touching an intraday low at $98.41b yesterday. They remain pressured by the…

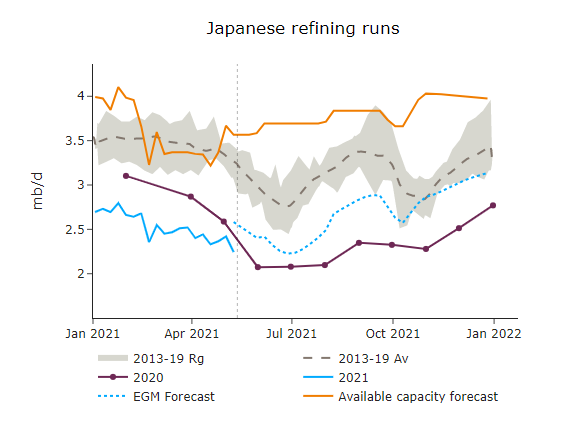

Crude prices remained stable at 68.8 $/b despite increasing concerns of refining throughput reduction, as the colonial pipeline crisis continued to be an issue for US petroleum markets. The API survey, which attempts to anticipate the EIA release, recorded a drop in commercial crude oil stocks of 2.5 mb, while gasoline stocks built by 5.6 mb. RBOB gasoline cracks, delivered in the NY Harbour, dropped below 25 $/b. Japanese runs declined further, as the state of emergency and seasonal weakness, left runs at 2.2 mb/d last week.

Get more analysis and data with our Premium subscription

Ask for a free trial here