Oil fell in the wake of equity market

Oil prices went down on Wednesday: ICE Brent for July delivery dropped by 2.5%, to settle at $109.11/b and NYMEX WTI for June delivery also…

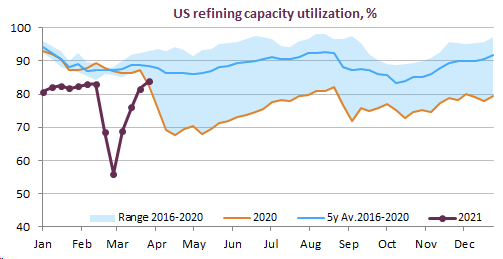

ICE Brent prompt contract recovered to 63.6 $/b on early Thursday after a loss on Wednesday. The EIA weekly report showed a rapidly improving US demand, with gasoline and jet outperforming expectations. Biden’s $2 trillion economic stimulus package showed a growing emphasis on road infrastructure, which will likely have a bullish outlook for industrial commodities and crude oil. Today’s OPEC ministerial meeting should yield a rollover of the production agreement.

Get more analysis and data with our Premium subscription

Ask for a free trial here