Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

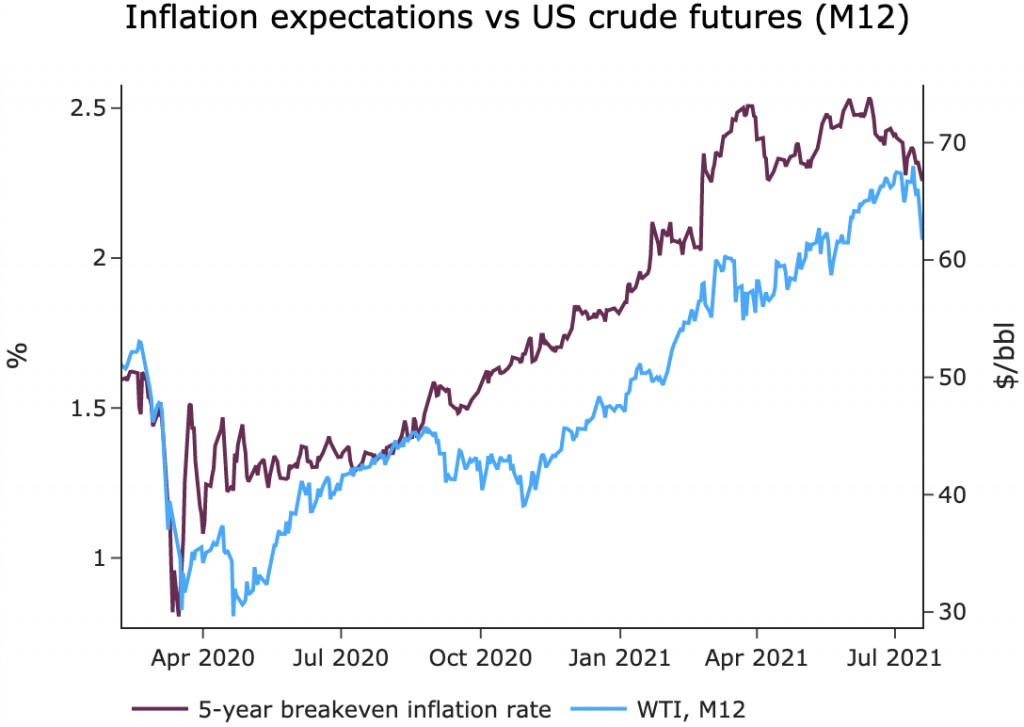

Falling inflation expectations, combined with collapsing equities globally, likely triggered a sell-off in crude and refined products futures. ICE Brent prompt contracts for September delivery went from 73 $/b to 69 $/b at the European close. All other futures prices from the oil complex experienced a similar decline. 10-year bond yields at 1.20% continue to reflect the buying pressure and greater reallocation towards fixed-income assets. All risky assets were therefore liquidated, particularly crude oil, as volatility already exceeded the equity market volatility. Prompt time spreads declined to respectively 56 cents and 15 cents for Brent and WTI. WTI prices were especially affected as the expiry for the August contract neared and liquidity dried up.

Get more analysis and data with our Premium subscription

Ask for a free trial here

ARA inventories continue to reflect this uneven scarcity across refined products. Naphtha and gasoline stocks plunged this week by 1.5 mb combined. Following the historic floods in Germany, this decline could persist, as rising Rhine water levels are making it impossible to ship barges of refined products (coming from inland refineries in Germany) through the river. Diesel stocks remained constant last week, while jet fuel stocks remained elevated, despite rising European flight numbers.