I have good and bad news…

I’ll start with the bad one as it explains the relapse of risky assets after yesterday’s rebound: Brent crude oil price close to $70/b, US 10-year yield below…

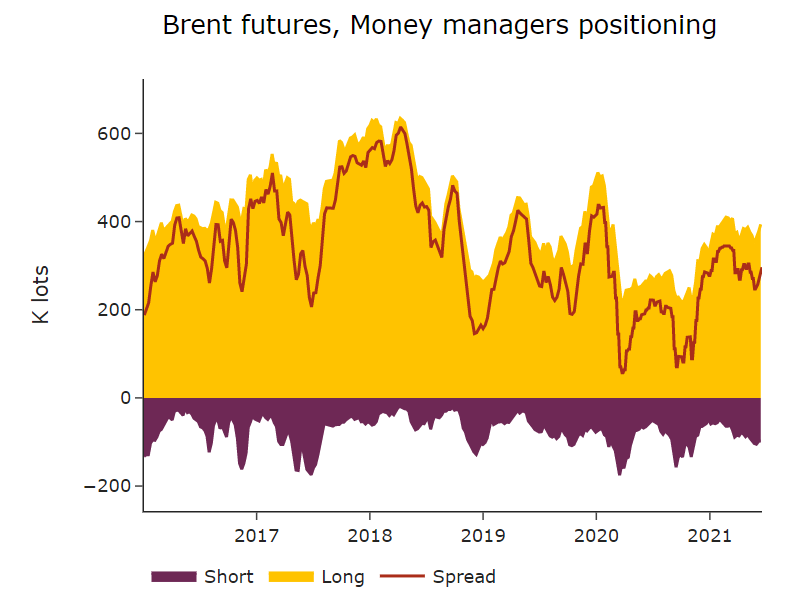

ICE Brent prices climbed to 73.8 $/b as Iranian talks held on Sunday yielded no outcome. West African barrels are now in demand, as parts of the August loading programmed were bid by European refiners, ahead of the fuel demand recovery. CFTC positioning is showing signs that the financial community is increasingly long crude futures contracts, and open interest is rising.

Get more analysis and data with our Premium subscription

Ask for a free trial here