WTI, the next leg up ?

The ICE Brent Dec-21 contract is consolidating at the 85 $/b, at odds with the rally in US equity markets, which usually boosts commodity prices. Indeed, the recent…

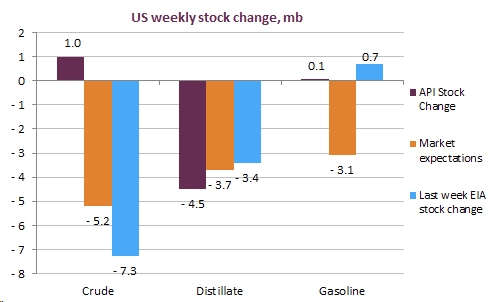

Brent prompt future contract slipped back to 65.3 $/b amid a significantly more bearish API release than expected. US crude stocks grew by close to 1 mb, as refining runs collapsed by 2 mb/d. Only distillate stocks drew at a rapid pace. US crude oil output is restarting at a faster pace than refining, as most producers and pipeline operators in the Permian are back to normal conditions. Russian crude and condensate output reached 10.09 mb/d in February so far, down from about 10.2 mb/d in January.

Get more analysis and data with our Premium subscription

Ask for a free trial here