Market anticipates ECB monetary tightening

Over the last two days, the German 10 year bond yield has increased by 7bp while the US 10 year is only up 3bp and…

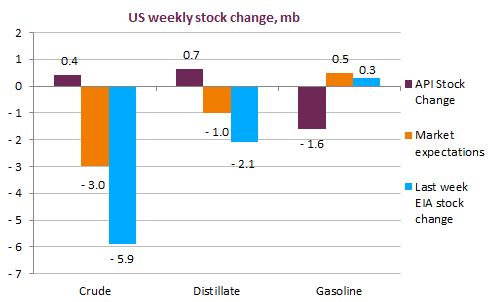

Crude oil prices pulled back to 66.3 $/b as the exponential growth of the pandemic in India continued to lower demand expectations for the third-biggest crude oil importer. The API survey showed a small build in crude stocks as US refining throughput declined slightly while gasoline inventories dropped by 1.6 mb. Japanese runs continued to edge lower, reflecting the demand weakness the archipelago currently faces.

Get more analysis and data with our Premium subscription

Ask for a free trial here