Extreme price volatility

In less than 2 hours yesterday, the price of Brent 1st-nearby first approached $115/b before plunging towards $104/b. It has since recovered to around $113/b. Fears of the…

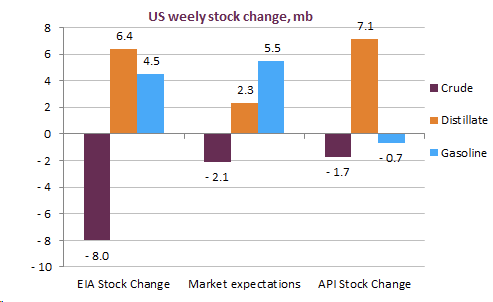

Brent prompt future contract remained pressured, at 63 $/b, as the OPEC meeting cycle started with the JMMC’s technical meeting yesterday. At the same time, the API survey showed large draws in product stocks and builds in crude stocks, in line with our forward crude balances. US refining runs surprised to the downside. On the other hand, Japanese runs recovered quickly following the earthquake last month, with throughputs back to 2.54 mb/d. US cracks continue to rally, as some refineries encountered ramp-up issues and technical issue.

Get more analysis and data with our Premium subscription

Ask for a free trial here