European prices extended gains

European gas prices extended gains yesterday, supported by rising temperatures, ongoing weak supply and strong Asia JKM prices (+2.59% on the spot, to €41.291/MWh). On…

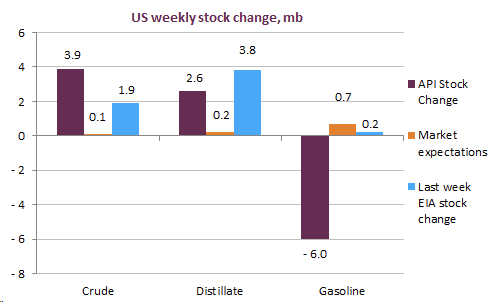

ICE Brent prompt month contract reached 64.6 $/b on early Wednesday, ahead of OPEC’s ministerial meeting, as most market observers expect OPEC to roll over the current production agreement, maintaining a tight grip on supply. The API survey showed indeed that OPEC’s return to the market was premature, with builds crude stocks close to 4 mb. However, declining gasoline stocks continued to be a warning sign for the US, as Gasoline demand likely outpaced 9 mb/d, a level for which current refining utilization is too low to supply the market.

Get more analysis and data with our Premium subscription

Ask for a free trial here