Covid wave in China triggered oil prices drop

Oil prices plunged yesterday, before recovering somewhat, in line with the US stock market: the ICE Brent front month fell to $99.5/b, before rebounding to $102.32/b…

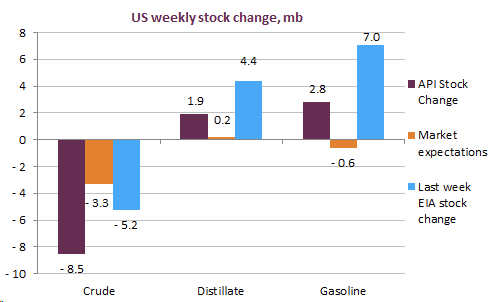

ICE Brent prompt contract continued to climb, at 74.2 $/b, as the API survey reported significant draws in US crude commercial stocks, while products inventories built at a more moderate pace. Cushing stocks are seen down by 1.5 mb, indicating further tightness for the WTI market, ahead of the summer. Japanese crude commercial stocks also declined by 5.6 mb, reflecting rising runs in Japan, ahead of the Olympics. Federal drilling auctions in the US may now resume after a federal US court challenged the Biden administration’s push to curtail further federal oil and gas leases.

Get more analysis and data with our Premium subscription

Ask for a free trial here