Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

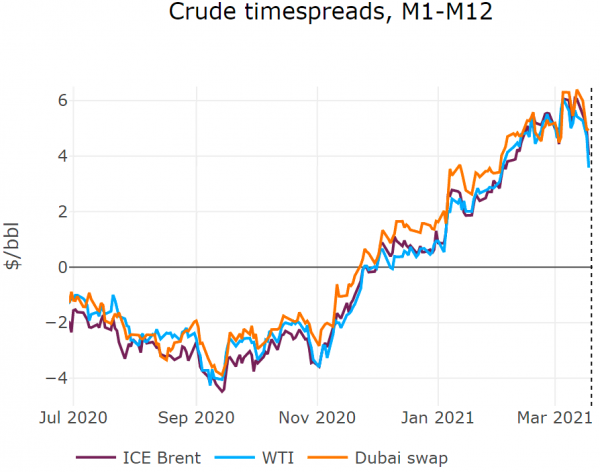

The collapse in refining margins was a prelude to the significant downward correction experienced on Brent and WTI markets. Crude prices dipped by more than 3 $/b within a day, as worries about crude and product demand were finally reflected in crude prices. European COVID policies continue to under-deliver, with the delay of the vaccination campaign by a week led by concerns over AstraZeneca’s vaccine, postponing the long-awaited economic recovery. Brazil continues to be the epicentre of the pandemic. Despite a good rebound of fuel consumption in the country, restrictive measures could be considered as daily fatalities reached 2.6k.

Get more analysis and data with our Premium subscription

Ask for a free trial here