EUAs traded rangebound amid mixed drivers

The power spot prices dropped further in north western Europe yesterday amid forecasts of milder temperatures and stronger wind production. Prices fell by 8.49€/MWh to…

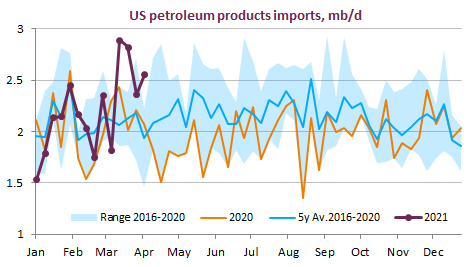

Despite dwindling US crude inventories, global crude prices fell on Wednesday and remained below 63 $/b for prompt ICE Brent contracts, as surprise builds in US gasoline stocks and worsening health situation in Europe, Canada and India limited the upside. With Russia producing at a higher rate in April and the US State department highlighting that the US is ready to lift Iranian sanctions as soon as Iran rejoins the JCPOA, extra supplies could arrive ahead of the demand boost expected this summer.

Get more analysis and data with our Premium subscription

Ask for a free trial here