Oil prices sharply on the rise

The Brent 1st-nearby price jumped higher from below $69/b to above $72/b, while the WTI posted an even-bigger rebound from around $66.5/b to $70.3/b now. Crude…

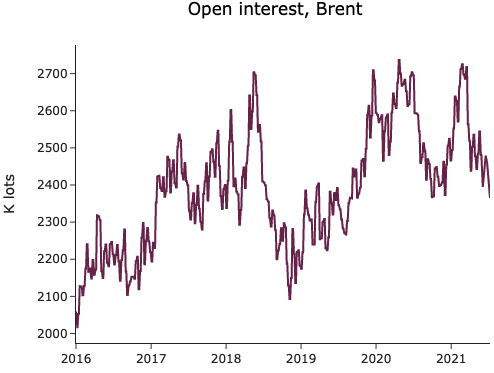

Last week’s crude oil price decline was likely caused by a broad selloff in Brent and WTI futures, as total open interest declined significantly. Looking at ICE Brent futures positioning, every category (managed- money, merchant players, swap dealers) reduced their exposure, as volatility was expected to rise, amid an uncertain OPEC+ production policy.

Get more analysis and data with our Premium subscription

Ask for a free trial here

Last week’s crude oil price decline was likely caused by a broad selloff in Brent and WTI futures, as total open interest declined significantly. Looking at ICE Brent futures positioning, every category (managed- money, merchant players, swap dealers) reduced their exposure, as volatility was expected to rise, amid an uncertain OPEC+ production policy.