Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

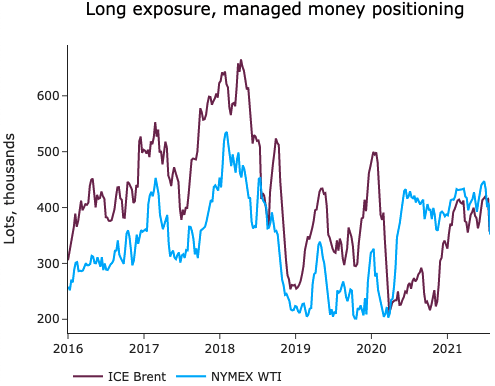

ICE Brent September contract traded at 73.3 $/b on early Monday, on a backdrop of declining US bond yields, depressing the price of risky assets such as Asian equities and commodity prices. On Friday, we learned more about last Monday’ sell-off which shaved 7% off on most oil futures after regaining slowly their values throughout the week. Indeed, the CFTC positioning report points to a broad selloff from “Money managers” across WTI and Brent contracts. long exposure declined respectively by 58k lots and 57k lots for Brent and WTI contracts for financial players. Time spreads regained ground, with ICE Brent Sept/Oct spread at 0.67, while WTI time spreads declined further, amid a weak expiry.

Get more analysis and data with our Premium subscription

Ask for a free trial here

Given how bond yields have recently been a driver of crude oil futures, we expect the Fed meeting on Tuesday to be highly influential on oil futures, as further declines in bond yields could continue to affect Brent and WTI prices.