EUAs climbed to new record above 64€/t

The European power spot prices for today observed mixed variations from Friday to reach close levels near 140€/MWh. Averaging 141.94€/MWh in the four countries, the…

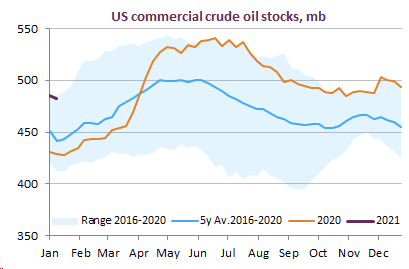

Brent prompt future prices retreated further at 55.7 $/b as growing concerns about the Chinese health situation raised concerns about Chinese oil demand prospects. President Biden unveiled the 1.9 trillion stimulus package designed to limit the economic effects of the pandemic. The US Dept of Energy is planning to release strategic petroleum reserve stocks in April of about 20 mb. Brent time spreads weakened further to reach 1cts, as prompt balances are anticipated to remain weak over February.

Get more analysis and data with our Premium subscription

Ask for a free trial here

We will get back in touch with you soon.

Don’t forget to follow us on twitter!