Financial markets regain some composure

Governments continue to take measures both to limit the spread of the variant Delta, which is putting real pressure on hospital occupancy, and to prevent the…

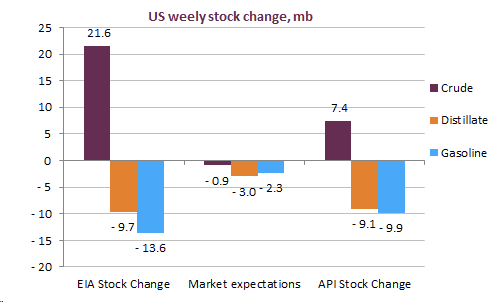

Brent prompt future contract significantly recovered yesterday, to reach 64.7 $/b. Crude prices were boosted by rumours that OPEC members could roll over the current production cut, which would overly tighten the market, according to our balances. At the same time, the EIA reported a shocking 21 mb crude inventory build, 3 standard deviations away from the average historical build, amid a markedly slower restart of US refineries. Products inventories dipped by unprecedented numbers, leaving total oil products inventories lower w/w.

Get more analysis and data with our Premium subscription

Ask for a free trial here