Markets resolve to consider much less favourable scenarios

Macro & Oil Podcast #23 In this episode of the weekly EnergyScan podcast about the Macro & Oil market, Olivier Gasnier tells us about the…

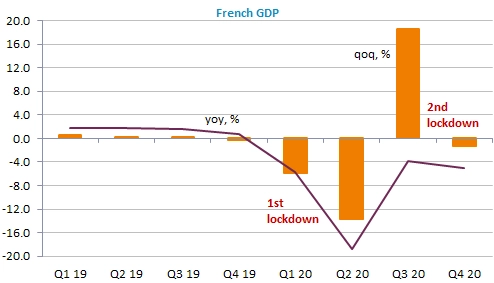

First estimates of national accounts in Q4 point to resilient activity or much more resilient than feared. Q1 should be very different, in Europe at least. Financial markets are still very volatile, although the VIX fell back towards 30. The “war” between retail traders ad Hedge Funds looks far from being over. It has undergone multiple twists and turns over the last 24 hours. There is also the shortage of vaccines which is disrupting vaccination campaigns in Europe and clouds recovery prospects. The EUR/USD does not deviate too far from the level of 1.21.

Get more analysis and data with our Premium subscription

Ask for a free trial here

We will get back in touch with you soon.

Don’t forget to follow us on twitter!