Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

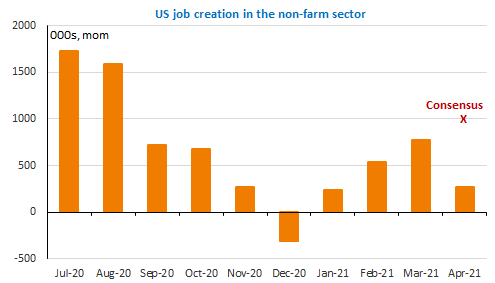

The EUR/USD exchange rate is trading at its highest level since early February, above 1.2150, after US job creation came out much lower than expected in April: +266k vs 1 million. The equity market welcomed the figures, while bond yields edged up, in line with inflation expectations. Why? Because they validate the Fed’s accommodative stance. The reasons behind this surprise remain unclear nevertheless and we think the series is too volatile to draw solid conclusions on the basis of one month’ figures. The economic agenda is empty today, but many key US economic reports will be released this week, with an expected sharp acceleration in inflation.

Get more analysis and data with our Premium subscription

Ask for a free trial here