Global gas prices resume their ascent

European gas prices skyrocketed on Tuesday as GTSOU failed to sell monthly interruptible transport capacity at the UA/RU border once again, fuelling concerns over a…

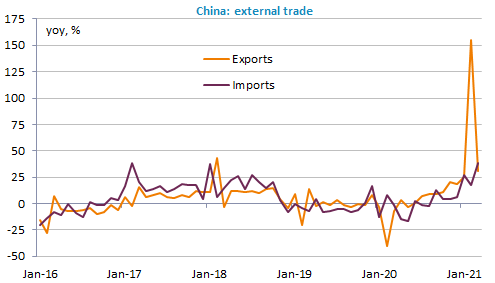

No big thing yesterday on financial markets but a gradual increase in bond yields that seems to reflect caution ahead of key economic reports in the US, to begin with CPI data today. The surge in Chinese exports and imports on a yoy basis in March reflects basis effects: we are entering a period during which it will be very difficult to draw anything from activity indicators. The EUR/USD exchange rate is still trading slightly below 1.19.

Get more analysis and data with our Premium subscription

Ask for a free trial here