Sharp downward revision of the IMF economic growth forecast

The International Monetary Fund cut its global growth forecast yesterday to 3.6% in 2022 and 2023, down from an estimated 6.1% in 2021. This is…

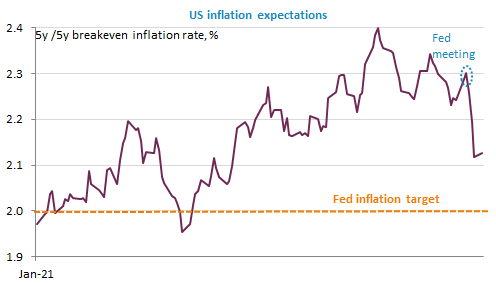

The impact of the Fed meeting is still being felt in the markets: inflation expectations have crashed (see the Graph of the day) and bond yields have followed, the US 10y falling below 1.4% overnight. The USD continued to strengthen. The EUR/USD pair plunged below 1.19. In parallel, equities plunged as well. This is the whole reflation trade that seems to be called into question.

Get more analysis and data with our Premium subscription

Ask for a free trial here