Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

Sentiment was positive yesterday but disappeared overnight with Asian equity markets down sharply and US futures down. Bond yields are edging down after a rebound and the USD has regained some ground after heavy losses (1.1880). US GDP growth figures were welcomed but concerns about the Chinese authorities’ attitude towards private companies and the resurgence of the pandemic in Asia came to the fore.

Q2 US GDP growth came in below expectations (6.5%), but its composition was rather reassuring. In addition, the persistently high level of jobless claims seemed to support the dove clan at the Fed. This last point is questionable insofar as the slower than expected improvement in the labour market seems to be more a reflection of insufficient labour supply, which could generate wage pressures. For more details on the US data, please refer to our note published yesterday.

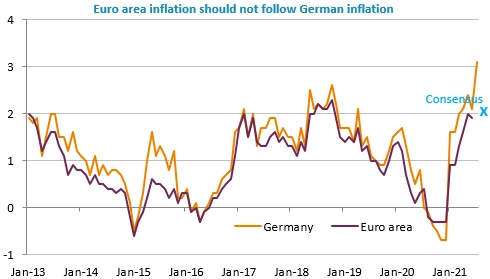

The economic agenda is still extremely busy today with the Eurozone’s Q2 GDP growth estimate expected to be quite close to that of the US GDP (+1.5% expected in non-annualised data). French GDP only grew by 0.9% qoq due to a late exit from containment compared to other countries. The July inflation rate for the Eurozone will also be published: it is expected to rise very slightly from 1.9% to 2% despite a strong acceleration in Germany from 2.1% to 3.1% but this was due to the VAT rate cut in July 2020. A few indicators in the US will also be published: consumption in June, Chicago PMI and consumer confidence.

Get more analysis and data with our Premium subscription

Ask for a free trial here