US colonial pipeline shutdown due to a ransomware

ICE Brent prompt prices were supported at 68.8 $/b by a rapidly weakening dollar and the shut down of the US colonial pipeline on Friday…

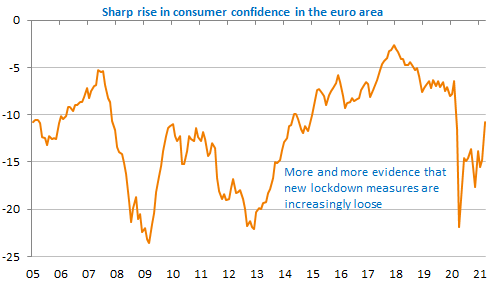

The sharp rise in the euro area PMIs as well as the consumer confidence indicators is at odds with the current narrative concerning the euro area. It may actually reflect the fact that lockdown measures are increasingly bypassed and, without any surprise, less and less efficient to stop the pandemic. Hopes are now fully placed in the strong rise in vaccine doses available from April. Financial markets are hesitant: bond yields have stabilized after a strong downward correction and the USD has followed the opposite path. The EUR/USD exchange rate is nearing 1.18.

Get more analysis and data with our Premium subscription

Ask for a free trial here