Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

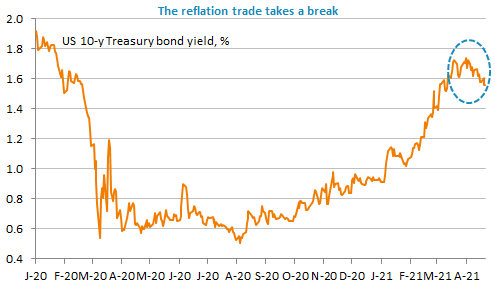

At least the movements on the financial markets were consistent yesterday. Equity markets were down and even sharply down in Europe. In parallel, after an initial increase nevertheless, bond yields registered a marked fall, the US 10y touching a 5-week low (price at a 5-week high). In a context dominated by risk aversion, the USD regained some ground: after having touched 1.2080, the EUR/USD exchange rate fell back towards 1.2030. The empty economic agenda puts the focus on the deterioration in Covid data, especially in India. Japan is adopting emergency measures for the umpteenth time in the main cities as well. The situation in Europe has started to improve very gradually, which will not allow a quick reopening of the economy.

Get more analysis and data with our Premium subscription

Ask for a free trial here