Lower credit rates in China

The yo-yoing continues on the markets: after a new decline in the equity markets yesterday and a sharp drop in long term rates (10 years…

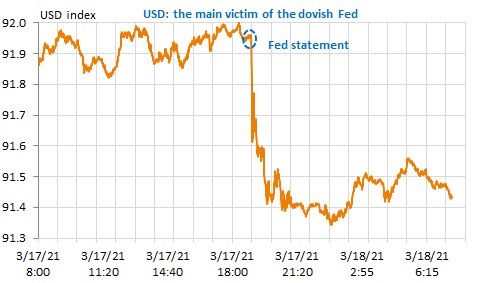

The Fed expressed more optimism about economic prospects, no worry about raising bond yields and saw no need to hike rates before 2024. The markets’ reaction was rather calm, but the USD plunged and the EUR/USD exchange rate rebounded unexpectedly from 1.19 to 1.1980.

Get more analysis and data with our Premium subscription

Ask for a free trial here