Macro & Oil Report: Already less growth but still too much inflation

Macro & Oil Podcast #39 Despite the recovery in China, the IMF is expressing fears about global growth and the Fed is raising the prospect…

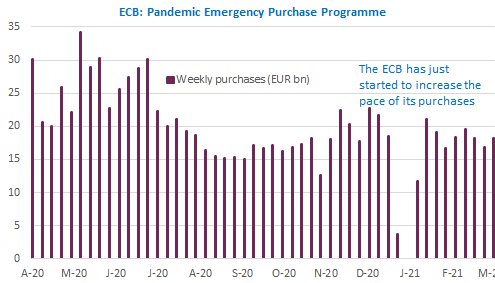

The ECB has already started to increase its asset purchases in order to address rising bond yields. There has been a curious respite on the US bond market in the wake of the vote of the stimulus package but yields are up again, while the move is smaller in the euro area, thanks to the ECB’s decision. In this context, the EUR/USD that has neared 1.20 yesterday, is logically retreating this morning, now below 1.1950. The market is probably going to increasingly test the Fed’s reluctance to intervene in order to cap the bond yields’ rise before its next meeting in two weeks.

Get more analysis and data with our Premium subscription

Ask for a free trial here