Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

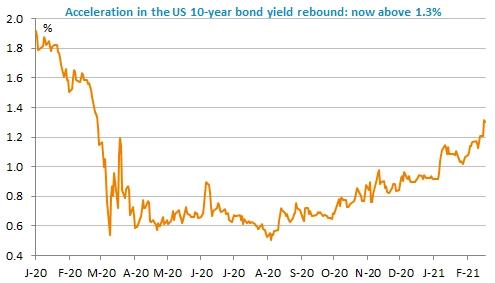

The fall in bond prices is accelerating, which means bond yields are on the rise. The US 10y reached 1.33%, 42 basis points above its level at the start of the year. They are good reasons for that: the fall in global Covid cases, especially in the US, the vaccination campaign and prospects of strong economic recovery. But there are also worries about the comeback of inflation that both fuel a vicious circle with commodity prices. Joe Biden repeated yesterday it was necessary to implement his huge stimulus package. Not everyone is convinced. The rise in bond yields broke the positive spiral in equity markets and the USD rebounded: the EUR/USD is trading below 1.21.

Get more analysis and data with our Premium subscription

Ask for a free trial here

We will get back in touch with you soon.

Don’t forget to follow us on twitter!