Euro Zone consumer confidence plunges to multi-year lows

The release of Consumer confidence data for June-22 in the Euro Zone showed that the index plunged to a new multi-year low at -23.6 (see…

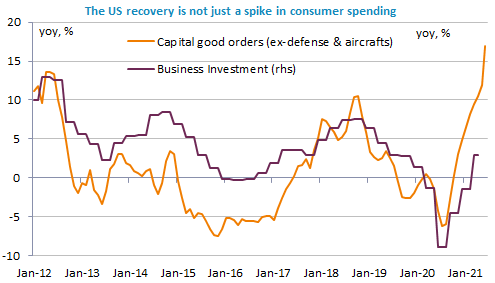

Financial markets came out of their torpor yesterday, as optimism came back with a vengeance. The release of good US economic reports as well as high expectations ahead of Mr. Biden’s budget announcements have supported equities, a move however thwarted by the parallel rebound in bond yields, the US 10y jumping above 1.6% again. This helped the USD to recover somewhat as well, the EUR/USD exchange rate falling below 1.22. The economic agenda is full today, with in particular personal spending and income data in the US as well as the core personal spending deflator, the Fed’s preferred measure of inflation.

Get more analysis and data with our Premium subscription

Ask for a free trial here