There is renewed concern

The US equity markets fell again yesterday, this time more sharply (-2% for the S&P 500 and -3% for the Nasdaq). The sharp decline in the…

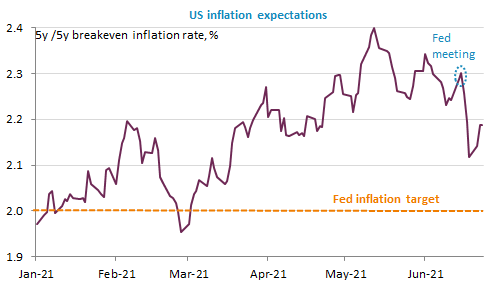

His written remark released on Monday had already shown he wanted to mitigate or even erase the effect of the “dots” on the market. His speech to Congress yesterday confirmed that. The equity market was on the rise again as well as inflation expectations, but they remain lower than before the Fed meeting. Same thing for bond yields, the 10y trading around 1.47%. The USD weakened further but has also kept some of its post-meeting gains against the euro: the EUR/USD is trading around 1.192 this morning.

Get more analysis and data with our Premium subscription

Ask for a free trial here