Crude prices fluctuate according to Suez canal news

Crude oil prices have registered up-and-down moves since the container ship blocked the Suez canal. Yesterday they were down, but are already rebounding. Brent 1st-nearby…

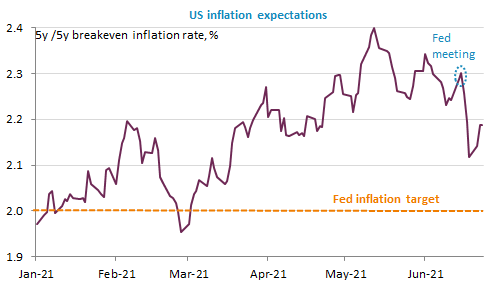

His written remark released on Monday had already shown he wanted to mitigate or even erase the effect of the “dots” on the market. His speech to Congress yesterday confirmed that. The equity market was on the rise again as well as inflation expectations, but they remain lower than before the Fed meeting. Same thing for bond yields, the 10y trading around 1.47%. The USD weakened further but has also kept some of its post-meeting gains against the euro: the EUR/USD is trading around 1.192 this morning.

Get more analysis and data with our Premium subscription

Ask for a free trial here