Libyan exports halted, stock builds in the US

ICE Brent prompt price hiked to 84 $/b for March delivery, as Libyan exports at one of the biggest ports were halted due to a…

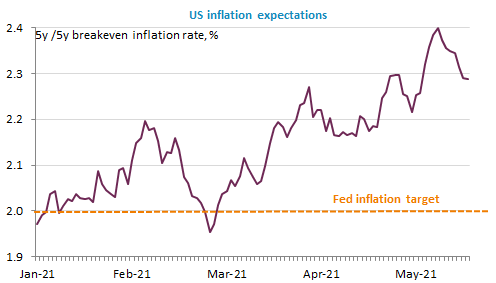

Equity markets rebounded, bond yields edged down and the USD weakened: the impact of the Fed minutes has evaporated or maybe the markets are relieved to see the Fed starting to face up to the inflationary risk as long as the economic recovery is being confirmed. Preliminary PMIs will be released today. The bad Japanese figures should not set the trend. The EUR/USD exchange rate is trading close to its February’s high, near 1.2240.

Get more analysis and data with our Premium subscription

Ask for a free trial here