European prices crashed yesterday

European gas prices crashed yesterday, both on the spot and the curve, extending their previous session’s sharp losses. The market ignored the drop in Norwegian…

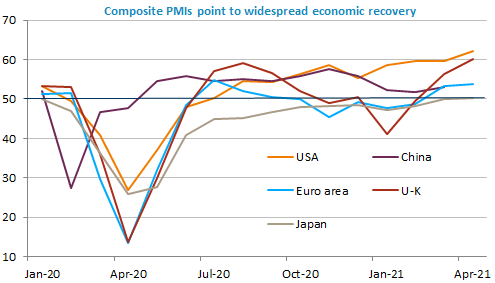

After a turbulent week, during which it focused on problems linked to vaccines and the catastrophic surge in the pandemic in India, the market seems calmer after the release of very encouraging PMI reports and ahead of a Fed meeting this week as well as corporate earnings that are expected to be good, especially for the tech sector. US equities were strongly on the rise on Friday, bond yields are edging up and the USD keeps on weakening: the EUR/USD exchange rate is now trading above 1.21.

Get more analysis and data with our Premium subscription

Ask for a free trial here