Power prices spiked to new records on news of a interconnector disruption

The power spot prices presented mixed variations for today, down in Germany and the Netherlands amid forecasts of sharply rising wind output for the upcoming…

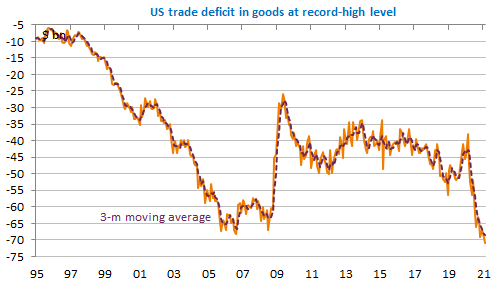

The release of the Fed minutes did not have any significant impact on markets, as the overall message remained strongly dovish, in line with consensus expectations. Equities and bonds remained rather stable as well as the USD, although the EUR/USD exchange rate briefly topped 1.19 yesterday. The sharp widening in the US trade deficit confirms the crucial role of the US economy in the global recovery.

Get more analysis and data with our Premium subscription

Ask for a free trial here