Higher coal prices lent support to gas prices

European gas prices were mixed yesterday on the spot and the near curve. Russian flows dropped significantly, averaging 225 mm cm/day, compared to 245 mm…

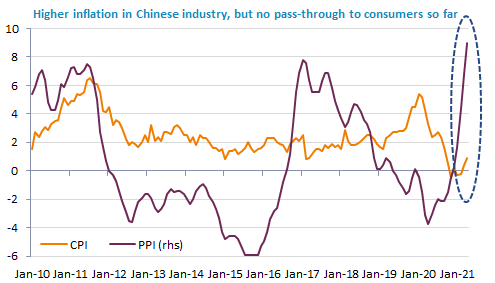

This was to be expected: market participants are waiting for tomorrow and the parallel releases of US inflation figures as well as the ECB’s decision on bond purchases. Meanwhile, very few notable news, although bond yields have lost some basis points, the US 10y falling to a 3-month low, below 1.52%. The EUR/USD exchange rate is rather stable, slightly below 1.22. Chinese price data confirmed upward price pressures in industry. Otherwise, there are very few market movers again today.

Get more analysis and data with our Premium subscription

Ask for a free trial here