Macro optimism boosts the front of the curve

ICE Brent futures were boosted late in the previous session (reaching 77.4 $/b on early Friday) by a jump in inflation expectations, which led to a…

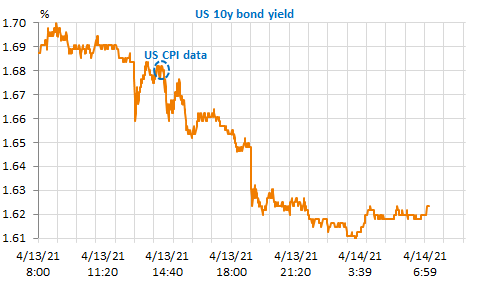

It was a key test for the bond market and it passed with flying colours. Higher-than-expected (but not that much) inflation figures were followed by further rise in equities, lower bond yields and a significant drop in the USD, the EUR/USD exchange rate increasing above 1.1950, a one-month high. The fact that Johnson & Johnson (JJ) delayed the planned rollout of its Covid vaccine in Europe after the US health agency called for a pause to investigate rare cases of blood clots had no major impact on markets either.

Get more analysis and data with our Premium subscription

Ask for a free trial here