EUAs rebounded after testing the psychological 40€/t level

The forecasts of surging wind output, stronger hydro generation and weaker demand weighed on the power spot prices in north western Europe on Thursday. Prices…

US equity markets have reached new all-time highs, underlining how fundamentally optimistic they remain. But more mixed Asian markets, the slight rise in bond yields (the 10-year US Treasury is close to 1.3%) and the upward tremor of the dollar (1.1740 against the euro) seem to reflect greater caution ahead of Jerome Powell’s key speech on Friday in Jackson Hole.

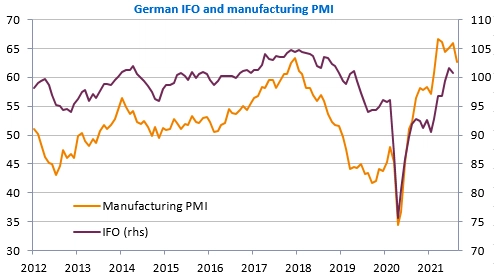

The IFO survey will be published this morning in Germany, followed by the durable goods orders this afternoon in the United States, but, barring any surprises, the market could adopt a wait-and-see attitude until Friday.

Get more analysis and data with our Premium subscription

Ask for a free trial here