Quiet day for the carbon market

The European power spot pruces continued to increase yesterday, supported by the wind shortage despite a weaker demand expected today and slightly lower clean gas…

US equity markets have reached new all-time highs, underlining how fundamentally optimistic they remain. But more mixed Asian markets, the slight rise in bond yields (the 10-year US Treasury is close to 1.3%) and the upward tremor of the dollar (1.1740 against the euro) seem to reflect greater caution ahead of Jerome Powell’s key speech on Friday in Jackson Hole.

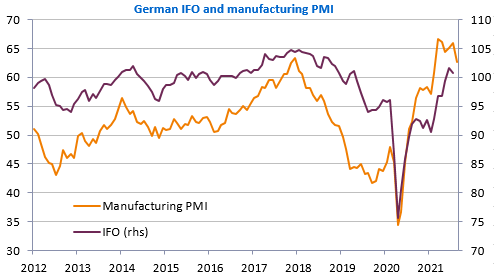

The IFO survey will be published this morning in Germany, followed by the durable goods orders this afternoon in the United States, but, barring any surprises, the market could adopt a wait-and-see attitude until Friday.

Get more analysis and data with our Premium subscription

Ask for a free trial here