Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

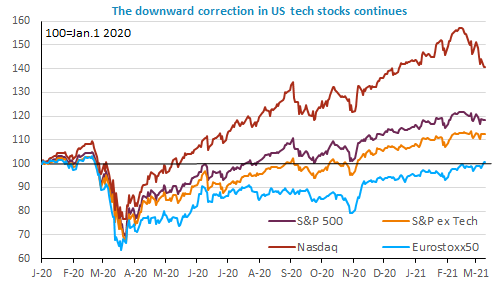

Higher bond yields and stronger growth expectations are driving investors away from assets that have benefited from the crisis to assets that have been left behind. The Nasdaq lost 2.5% again yesterday. Bond yields seem stabilizing for the time being nevertheless, which may offer some respite. The USD kept on strengthening, pushing the EUR/USD to 1.1836, near the key support of the 200-day moving average.

Thanks to some decline in bond yields (the US 10y is back below 1.55% this morning), Asian stock markets have rebounded, but US equities declined further yesterday, especially tech stocks, the Nasdaq entering in “correction” territory (down by more than 10% since its peak of February).

Get more analysis and data with our Premium subscription

Ask for a free trial here