Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

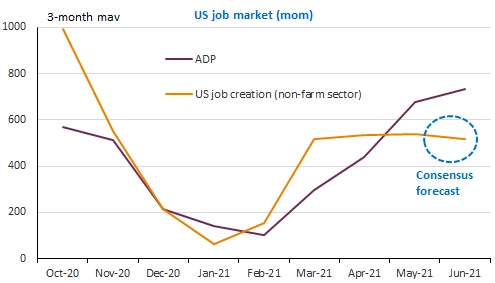

No real change on financial markets: equities keep on advancing on optimism about growth, except in Asia where the spread of the variant brings more uncertainty, as restrictive measures are adopted in many places. But overall, optimism is still being fueled by the fact that vaccines seem to offer a good protection. Yet, bond yields are back to their recent lows or declining and the USD is strengthening, which points to fragile confidence. The US job report released today is expected to show a rebound in job creation, but other indicators suggest this rebound could be much stronger than anticipated after two months of negative surprise. The EUR/USD exchange rate has declined further, below 1.1850.

Get more analysis and data with our Premium subscription

Ask for a free trial here