EUAs quickly retreated towards 50€/t after a bullish opening

The European power spot prices climbed just above the clean gas costs yesterday on forecasts of lower temperatures and wind production. All coupled, the day-ahead…

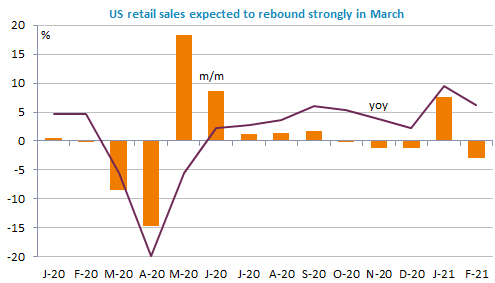

US equities reached new highs before profit taking brought down the main indices in the red, except the Dow Jones. The Fed Beige book perfectly illustrated the doubts that financial market players may be facing at the moment: the recovery is here and getting stronger but the tensions on means of production could lead to a consequent rise in inflation. Yet, the bond market remains very calm, the US 10y trading around 1.63%. The USD weakened further, with the EUR/USD exchange rate reaching 1.1990. Many key US economic reports are on the agenda today.

Get more analysis and data with our Premium subscription

Ask for a free trial here