Profit taking drove EUAs back in middle of the trading range

The European power spot prices are mixed for today compared to Friday as the dropping nuclear availability and higher clean gas costs supported the French…

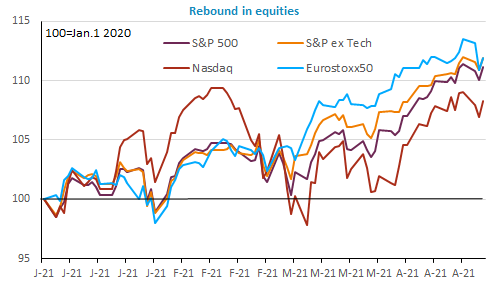

Equity markets rebounded yesterday, but bond yields fell to a new five-week low, which tends to suggest this is a fragile reprieve, mainly bases on corporate earnings that were expected to be good anyway and lower bond yields precisely. But the situation has not suddenly changed on the pandemic front and remains very worrying. The economic agenda is fuller today with the ECB meeting especially, although nothing really new is expected. The EUR/USD remains rather stable, above 1.20.

Get more analysis and data with our Premium subscription

Ask for a free trial here