Join EnergyScan

Get more analysis and data with our Premium subscription

Ask for a free trial here

Stocks are down, rates (US 10y at 1.34%) and the dollar (EUR/USD at 1.1760) are up very slightly: the market is logically playing it safe ahead of Jerome Powell’s key speech at 4pm (CET) today. Several Fed members (who are not voting on monetary policy decisions this year, however) have already set the tone yesterday by saying that the economic situation already justifies a reduction in asset purchases, despite the threats linked to the Delta variant. The market is already prepared for this: it is all a matter of timing and pace, but let’s bet that the Fed Chairman will not make a shocking announcement likely to trigger a brutal reaction.

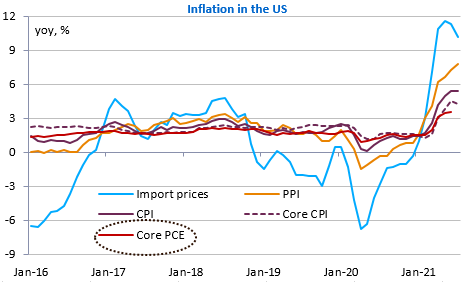

Before that, US consumer and household income figures will have been published for July at 2:30pm (CET) along with the inflation measure that the Fed looks at first: the core PCE deflator. This could make the market more or less nervous depending on what is published (+3.6% yoy expected by the consensus).

Get more analysis and data with our Premium subscription

Ask for a free trial here