Wait and see

The market is already in a wait-and-see mode before the ECB meeting and, above all, the release of May US inflation figures on Thursday. The…

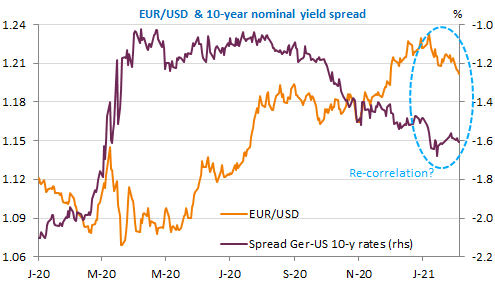

US economic reports may be too good for markets as they both tend to fuel inflationary fears and lower the need for a big stimulus package. The positive trend in the stock market has started to reverse. Asian markets also suffered from confirmation of the tough stance of the Biden administration vis-à-vis China. The Italian bond spread is narrowing on prospects of a Draghi government, but nothing is done. The euro keeps on weakening against the USD nevertheless, as the market seems catching up with the widening spread between the US and German bond yields.

Get more analysis and data with our Premium subscription

Ask for a free trial here

We will get back in touch with you soon.

Don’t forget to follow us on twitter!